INFORMATION FOR CASUALS

Changes for casual employees under the Protecting Worker Entitlements Act 2023.

Learn more

PROTECTING WORKER ENTITLEMENTS

Information for employers about changes as part of the Government's Protecting Worker Entitlements laws.

Learn more

LOGIN

LOGIN

04.

Calculating reimbursable amounts

Purpose of this Guidance Note

This information aims to assist employers to understand the way Coal LSL calculates the reimbursement of long service leave payments made by employers to employees.

Notes:

Where ‘LSL’ is referred to within this guidance, it means the long service leave entitlement referred to in the Coal Mining Industry (Long Service Leave) Administration Act 1992.

The Employer Reimbursement Rules 2017 (‘the 2017 Rules’) are legislation and are binding on Coal LSL. While this Guidance Note represents the opinion of Coal LSL, it is not intended as legal advice and is not determinative of legal rights or obligations.

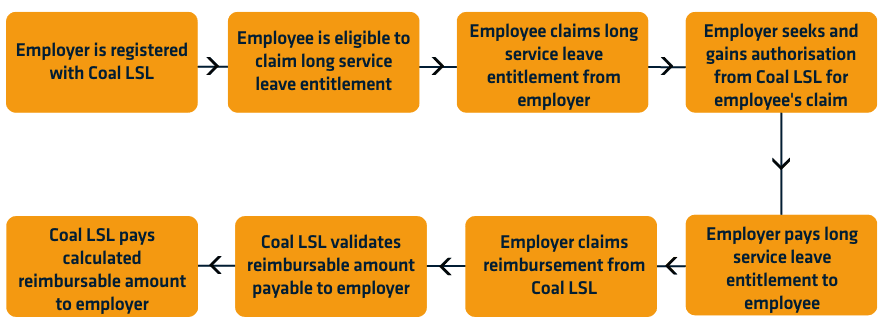

The reimbursement process

How does Coal LSL calculate a reimbursable amount?

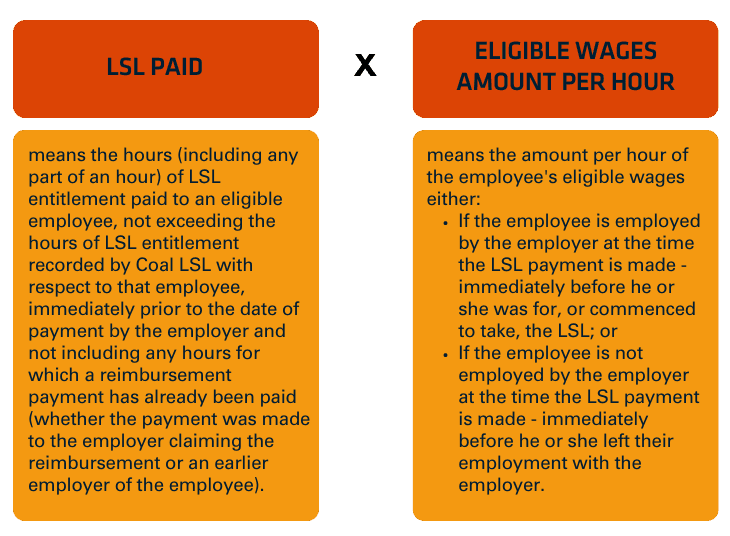

From 1 July 2017, the Employer Reimbursement Rules 2017 (‘the 2017 Rules’) revoked and replaced the earlier Employer Reimbursement Rules 2011 (‘the 2011 Rules’). Rule 9 of the 2017 Rules outlines the formula for calculation of the reimbursable amount:

LSL paid x eligible wages amount per hour

For the purposes of this formula:

Important note: An employer claiming reimbursement from Coal LSL will not be reimbursed any amount exceeding the amount which was paid by the employer for the employee’s long service leave entitlement.

Differences between the LSL entitlement paid to the employee and the reimbursable amount paid by Coal LSL:

The 2017 Rules use a single calculation method for determining the reimbursable amount and do not calculate pre-2012 and post-2012 entitlement claims separately.

The reimbursement calculation is based generally on the amount paid by the employer to the employee for the authorised long service leave and the eligible wages of the employee (see Guidance Note on Determining Eligible Wages).

There may be a discrepancy between the amount of long service leave paid by the employer and the amount which can be reimbursed by Coal LSL because an employer may pay an employee for more long service leave than the entitlement recorded by Coal LSL for that employee. This may occur due to the following scenarios:

Some of the employee's service which the employer recognises as counting towards a long service leave entitlement was not service as an ‘eligible employee’ under the Coal Mining Industry (Long Service Leave) Administration Act 1992 (the Admin Act);

The employer has paid for an amount of long service leave for the employee that has already been reimbursed by Coal LSL; or

The employer has agreed with an individual employee, or through an enterprise agreement, to pay for long service leave at a rate per hour that is greater than the employee's actual eligible wages amount per hour.

If there is doubt or uncertainty about the amount an employer is to be reimbursed, Coal LSL is able, under section 49 of the Admin Act, to make a determination in relation to the claim for reimbursement.

Claiming for reimbursement under the 2017 Rules

As noted above, the 2017 Rules came into force on 1 July 2017. The method for calculation of the reimbursement amount is based on the date Coal LSL receives the claim for reimbursement rather than the dates long service leave was taken or paid by the employer. For example:

Which rule applies?

Employee was on long service leave for the period 1 May 2017 to 1 June 2017 and Coal LSL receives claim for reimbursement from employer on 30 June 2017: the 2011 Rules apply because the claim was received prior to 1 July 2017.

Employee is on long service leave for the period1 May 2017 to 1 June 2017 and Coal LSL receives claim for reimbursement from employer on 30 July 2017: the 2017 Rules apply because the claim was received after 1 July 2017.

Employee is on long service leave for the period 30 May 2017 to 1 August 2017 and Coal LSL receives claim for reimbursement from employer on 30 August 2017: the 2017 Rules apply.